Financial Intermediaries in the Stock Market When beginners start learning about the stock market, they usually think that shares are bought directly from the company or sold directly to another person.

But in reality, many institutions work in the background to make stock market transactions smooth and safe.

These institutions are called Financial Intermediaries.

What Are Financial Intermediaries?

Financial intermediaries are organizations that act as a bridge between investors and the stock market.

They help buyers and sellers complete transactions in a secure and organized way.

In simple words:

You cannot directly access the stock market.

Financial intermediaries help you do that.

Without them, buying or selling shares would be very confusing and risky.

Why Are Financial Intermediaries Important?

Imagine a stock market without any system:

- No one checks if money is paid properly

- No one ensures shares are delivered

- No one protects small investors

This would create chaos.

Financial intermediaries make sure that:

- Trades are completed smoothly

- Investors’ money and shares are safe

- Rules and processes are followed

Types of Financial Intermediaries in the Stock Market?

1. Stock Broker

A stock broker is the most common intermediary for retail investors.

A broker is a company that allows you to buy and sell shares through its app or website.

Examples: Zerodha, Groww, Angel One, Upstox etc.

Simple Example:

Suppose you want to buy shares of Infosys.

- You place a buy order using your broker’s app

- The broker sends your order to the stock exchange (NSE/BSE)

- The exchange matches your order with a seller

- Tasks: They execute your orders, provide “Contract Notes” (digital bills), and help transfer funds.

Without a broker, you cannot place an order in the stock market.

2.Depository and Depository Participant (DP)

When you buy shares, they are not given to you in paper form.

They are stored digitally in your Demat account.

This is handled by Depositories.

- Depository = Stores shares in digital form

- DP (Depository Participant) = Connects investors to the depository

In India, the main depositories are NSDL and CDSL.

Example: Financial Intermediaries in the Stock Market

You buy 10 shares of TCS.

These shares are stored electronically in your Demat account, managed by a depository.

This system keeps your shares safe, secure, and easy to track.

3.Banks

Banks play an important role in money transfer during trading.

Whenever you:

- Buy shares → money is deducted from your bank account

- Sell shares → money is credited to your bank account

Example:

You buy shares worth ₹5,000.

- Bank transfers ₹5,000 to your broker

- Broker completes the transaction

Banks ensure that funds move safely and on time.

4.Clearing Corporation

The clearing corporation ensures that every trade is completed properly.

It checks:

- Buyer has enough money

- Seller has enough shares

- Settlement happens on time

Example:

If you buy shares today:

- Clearing corporation ensures you receive shares

- Seller receives money

- Trade is settled without default

This happens in the background, but it is very important.

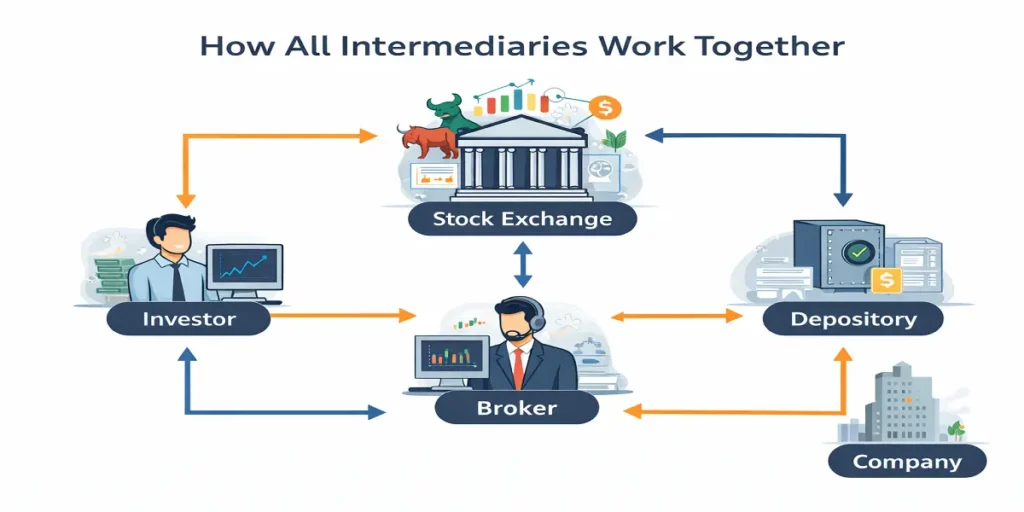

How All Intermediaries Work Together

Here’s how the system works step by step:

- Investor places an order using a broker

- Broker sends the order to the stock exchange(NSE OR BSE)

- Exchange matches buyer and seller

- Clearing corporation confirms settlement

- Bank transfers money

- Depository updates share ownership

All this happens smoothly because intermediaries coordinate with each other.

Real-Life Analogy 2: Property Buying 🏠

Jab koi ghar kharidta hai:

- Buyer & Seller → Investor & seller

- Property dealer → Stock Broker

- Bank loan / payment → Bank

- Registry office → Depository + Clearing system

Property dealer deal smooth karta hai,

registry ownership record karti hai,

bank payment handle karta hai.

👉 Stock market me bhi intermediaries ownership + payment + process handle karte hain.

ALSO READ: Learning Stock Market:(FREE)

🎯 Smart Goal Planner

साधारण मासिक SIP: ₹0

FAQS:

Who are the intermediaries in the stock market?

Stock market intermediaries are regulated entities that facilitate, settle, and manage transactions between investors and issuers, ensuring the smooth functioning of the securities market. Key intermediaries include brokers, depositories (NSDL/CDSL), depository participants, clearing corporations, merchant bankers, and bankers to an issue.

What are the 4 main financial intermediaries?

The four main intermediaries you will interact with are:

1.Stock Brokers (like Zerodha)

2.Depositories/DPs (like CDSL and NSDL)

3.Banks

4.Clearing Corporations (like NSE Clearing Limited)

Is the stock market a financial intermediary?

No, the stock market (Exchange) is the platform where trading happens. The organizations that help you use this platform are the intermediaries.

Is Zerodha an intermediary?

Yes. Zerodha acts as both a Stock Broker (giving you access to the market) and a Depository Participant (helping you hold shares in a Demat account).

What are 5 examples of financial intermediaries?

Zerodha (Stock Broker)

CDSL (Central Depository Services Limited)

HDFC Bank (Clearing Bank)

NSE Clearing Limited (Clearing Corporation)

Registrar and Transfer Agents (RTA) (Manage company records)

What are Primary Market intermediaries?

In the primary market (like an IPO), the intermediaries include Merchant Bankers, Registrars to an Issue, and Underwriters who help companies launch their shares for the first time

Capital market intermediaries in India?

In India, all intermediaries like Brokers, DPs, and Clearing Houses must be registered with and regulated by SEBI to ensure investor safety.

Summary

Financial intermediaries are the backbone of the stock market.

They help investors buy and sell shares safely by managing money transfers, share storage, and trade settlement.

For beginners, understanding financial intermediaries is important because it shows that the stock market is not random—it is a well-organized system designed to protect investors and ensure smooth transactions.

⚠️ Disclaimer

Ye article sirf educational purpose ke liye hai. Ye koi investment advice nahi hai.